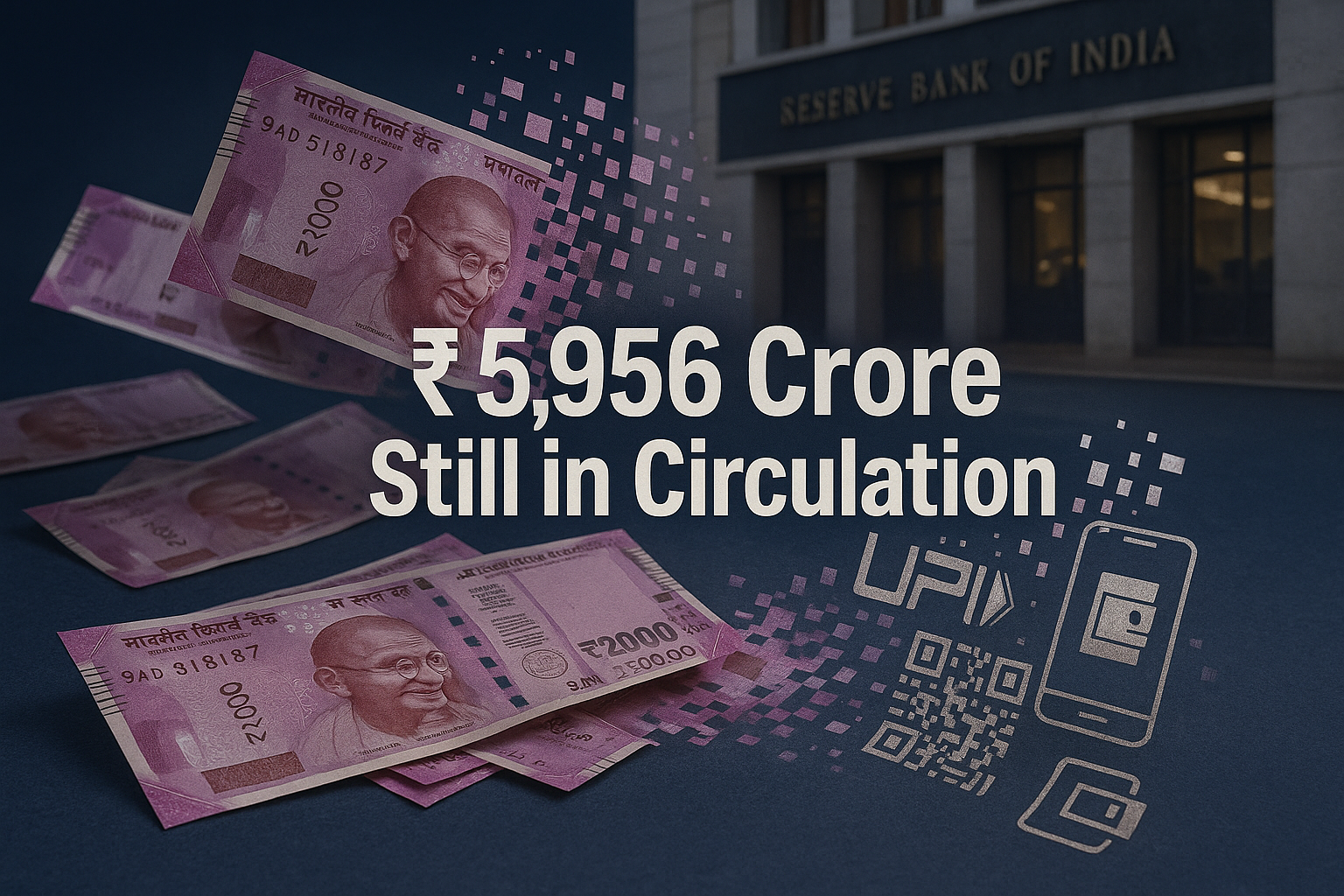

The Reserve Bank of India (RBI) has reported that ₹2,000 denomination notes worth ₹5,956 crore are still in circulation, despite the withdrawal directive issued in May 2023. While the majority of these high-value notes have been returned to the banking system, a small fraction continues to remain with the public, either unexchanged or held as savings.

The data underscores RBI’s continued push for currency management efficiency and its long-term shift toward promoting digital payments and smaller denominations.

Background of ₹2,000 Note Withdrawal

The ₹2,000 note was introduced in November 2016 after demonetisation to quickly remonetize the economy. However, by May 2023, RBI announced its withdrawal from circulation, citing:

Limited use in daily transactions.

Concerns around hoarding and illicit use.

Availability of adequate lower denominations and digital payment adoption.

Banks were directed to facilitate deposits and exchanges, leading to the return of most notes within months.

Current Status of Circulation

As per RBI’s latest update:

₹2,000 notes worth ₹5,956 crore remain unreturned as of July 2025.

This is a sharp decline compared to the total ₹3.56 lakh crore in circulation when the withdrawal announcement was made.

Most of the outstanding notes are expected to either be held as keepsakes or slowly find their way back through banking channels.

Implications for Currency Management

The residual circulation of ₹2,000 notes highlights important trends in India’s monetary ecosystem:

Public Adaptation: Citizens have largely shifted to lower denominations and digital transactions.

Currency Efficiency: RBI has been successful in gradually phasing out high-value notes without causing liquidity disruption.

Digital Push: The limited use of ₹2,000 notes underscores the acceleration toward UPI and digital wallets.

Why This Matters

For Citizens: Signals near-complete phase-out of ₹2,000 notes from daily use.

For Policymakers: Reflects successful execution of a large-scale withdrawal process.

For Economy: Reinforces the ongoing shift toward digital-first financial ecosystems.

The small residual circulation marks the final leg of India’s high-denomination phase-out, strengthening transparency and monetary discipline.